The Rise of AI Startups in the U.S.: Where Investors Are Putting Their Money in 2026

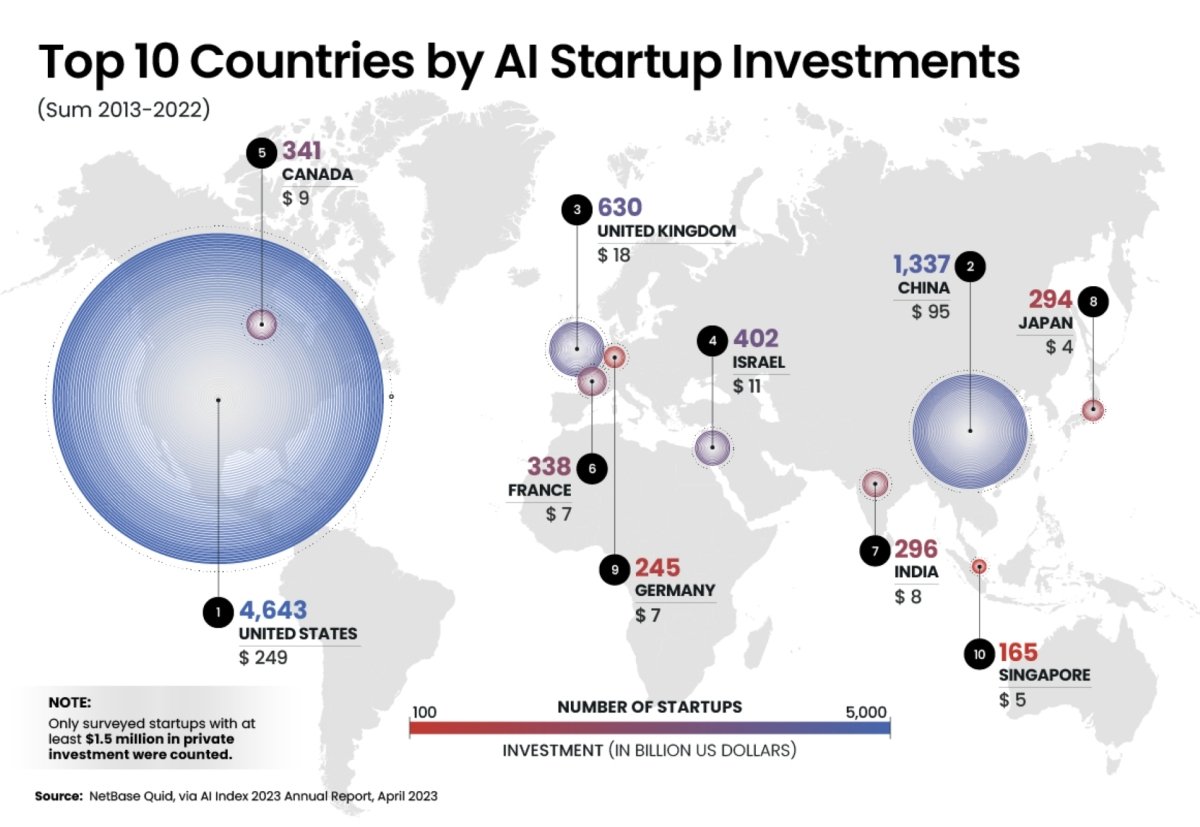

The United States has emerged as a hub for Innovation-and-adoption/” title=”US Artificial Intelligence Boom: 2026 as AI’s Turning Point in Innovation and Adoption”>Artificial Intelligence (AI) startups, attracting significant investments from both domestic and international investors. According to recent forecasts, the AI market is expected to grow exponentially, with Nvidia’s chief Jensen Huang predicting that AI infrastructure spending will reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This growth is being driven by the increasing demand for AI-powered solutions across various industries, including healthcare, finance, and transportation.

Investors are taking notice of this trend, with many putting their money into AI startups that are developing innovative solutions in areas such as natural language processing, computer vision, and robotics. One such example is Nvidia, a leading provider of AI chips that has seen explosive earnings growth in recent years (Source 1). Despite concerns about tariffs and economic growth, Nvidia’s valuation remains reasonable at 38x forward earnings estimates, making it an attractive investment opportunity for those looking to capitalize on the AI trend.

According to Vanguard’s global outlook summary, AI investment is expected to be a key driver of economic growth in 2026, with a potential 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years (Source 2). This growth is expected to be fueled by AI-driven physical investment, which is reminiscent of past periods of major capital expansion such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge.

However, the AI market is not without its risks. As Vanguard notes, AI investment’s outsized contribution to economic growth represents a key risk factor in 2026, and investors should be cautious of an AI bubble forming (Source 2). Nevertheless, for those who are willing to take on this risk, the potential rewards are significant, making AI startups an attractive investment opportunity in 2026.

Some of the key areas where investors are putting their money in AI startups include:

- Natural Language Processing (NLP): NLP is a key area of focus for AI startups, with many developing solutions that can understand and generate human language. Companies such as Google, Amazon, and Microsoft are investing heavily in NLP, and startups that can develop innovative solutions in this area are likely to attract significant investment.

- Computer Vision: Computer vision is another key area of focus for AI startups, with many developing solutions that can interpret and understand visual data from images and videos. Companies such as Facebook, Apple, and Google are investing heavily in computer vision, and startups that can develop innovative solutions in this area are likely to attract significant investment.

- Robotics: Robotics is a key area of focus for AI startups, with many developing solutions that can automate tasks and improve efficiency. Companies such as Amazon, Google, and Microsoft are investing heavily in robotics, and startups that can develop innovative solutions in this area are likely to attract significant investment.

- Autonomous Vehicles: Autonomous vehicles are a key area of focus for AI startups, with many developing solutions that can enable cars to drive themselves. Companies such as Tesla, Uber, and Waymo are investing heavily in autonomous vehicles, and startups that can develop innovative solutions in this area are likely to attract significant investment.

Overall, the rise of AI startups in the U.S. is a trend that is likely to continue in 2026, with investors putting their money into companies that are developing innovative solutions in areas such as NLP, computer vision, robotics, and autonomous vehicles. While there are risks associated with investing in AI startups, the potential rewards are significant, making this a attractive investment opportunity for those who are willing to take on the risk.

The AI Infrastructure Spending Boom

The U.S. is on the cusp of an AI infrastructure spending boom, with Nvidia chief Jensen Huang predicting that AI infrastructure spending will reach between $3 trillion and $4 trillion by the end of the decade. This surge in spending is driven by the increasing demand for AI capabilities across various industries, including cloud service providers, healthcare, finance, and manufacturing.

Nvidia, a leader in AI chip design, is poised to benefit from this trend. The company’s customers, such as Amazon and Microsoft, are expanding their capacity to meet the growing demand for AI infrastructure. This increased demand for high-performance chips, such as Nvidia’s GPUs, is expected to drive earnings growth and stock price gains for the company in 2026.

According to Vanguard’s economic and market outlook, AI investment is expected to be a powerful force in driving economic growth, with a 60% chance of the U.S. economy achieving 3% real GDP growth in the coming years. This growth is expected to be driven by AI-driven physical investment, which is reminiscent of past periods of major capital expansion, such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge.

The AI infrastructure spending boom is not limited to the U.S., with other countries also investing heavily in AI infrastructure. China, for example, is expected to see real GDP growth of 5% in 2026, driven by AI-related dynamics. The euro area, on the other hand, is expected to see growth hovering near 1% in 2026, as the drag from higher U.S. tariffs is offset by increased defense and infrastructure spending.

The AI infrastructure spending boom presents significant opportunities for investors, particularly those who are invested in companies that are poised to benefit from this trend. Nvidia, in particular, is well-positioned to capture a significant share of the growing market for AI infrastructure, making it an attractive investment opportunity in 2026.

(Source: https://www.fool.com/investing/2025/11/29/real-reason-this-ai-stock-could-win-2026/ and https://corporate.vanguard.com/content/corporatesite/us/en/corp/vemo/ai-exuberance-economic-upside-stock-market-downside.html)

Nvidia’s Dominance in the AI Chip Market

Nvidia’s dominance in the AI chip market is likely to remain unchallenged in the foreseeable future, driven by its early mover advantage and continuous innovation in the space. According to a prediction made by Nvidia’s CEO, Jensen Huang, AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This massive investment in AI infrastructure will create a substantial demand for high-performance chips, which Nvidia is well-positioned to supply.

Nvidia’s customers, including cloud service providers Amazon and Microsoft, have already spoken of soaring demand and their plans to expand capacity, further solidifying Nvidia’s position in the market (Source 1). The company’s GPUs are the top-performing chips in the industry, and its Blackwell architecture and Blackwell Ultra updates have been met with strong demand.

Moreover, Nvidia’s valuation remains reasonable at 38x forward earnings estimates, which is lower compared to other AI stocks (Source 1). This makes it an attractive investment opportunity for investors looking to capitalize on the growth of the AI market.

The dominance of Nvidia in the AI chip market is likely to be further reinforced by the ongoing wave of AI-driven physical investment, which is expected to be a powerful force driving economic growth (Source 2). This investment cycle is still underway, supporting the projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years.

In summary, Nvidia’s dominance in the AI chip market is likely to remain unchallenged due to its early mover advantage, continuous innovation, and strong demand from its customers. The massive investment in AI infrastructure and the ongoing wave of AI-driven physical investment will further solidify Nvidia’s position in the market, making it an attractive investment opportunity for investors looking to capitalize on the growth of the AI market.

AI Investment and Economic Growth

The rise of AI startups in the U.S. has led to significant investment in the sector, with investors placing their bets on companies that are at the forefront of AI innovation. According to Joe Davis, global chief economist at Vanguard, AI investment is expected to have an outsized contribution to economic growth in 2026 (Source 2). In fact, Vanguard’s analysis suggests that AI investment’s capacity to transform the labor market and drive productivity will be a key risk factor in 2026.

One of the key reasons for this optimism is the expected growth in AI infrastructure spending. Nvidia’s chief Jensen Huang has predicted that AI infrastructure spending will reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This spending is expected to drive demand for the world’s top-performing chips, which are currently dominated by Nvidia’s GPUs.

As a result, Nvidia is well-positioned to benefit from this trend, with its valuation remaining reasonable at 38x forward earnings estimates (Source 1). This, combined with the company’s ongoing innovation and strong demand from customers such as cloud service providers Amazon and Microsoft, makes Nvidia a compelling investment opportunity in 2026.

The impact of AI investment on economic growth is expected to be significant, with Vanguard forecasting up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years (Source 2). This growth is expected to be driven by AI-driven physical investment, which is reminiscent of past periods of major capital expansion such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge.

However, it’s worth noting that the first half of 2026 may be softer due to lingering effects of stagflationary megatrend shocks, including tariffs and demographics, as well as yet-to-materialize broad-based gains in worker productivity (Source 2). Nevertheless, the labor markets are expected to stabilize by the end of 2026, helping the unemployment rate to stay below 4.5%.

Overall, the rise of AI startups in the U.S. is expected to have a significant impact on economic growth in 2026, with AI investment driving demand for top-performing chips and transforming the labor market. As a result, investors who are looking to capitalize on this trend may want to consider companies such as Nvidia, which is well-positioned to benefit from the growth in AI infrastructure spending.

The Role of AI in Transforming the Labor Market

The integration of Artificial Intelligence (AI) in various industries has been transforming the labor market at an unprecedented rate. As per the report by Vanguard’s global chief economist, Joe Davis, AI investment is expected to counteract negative shocks and drive economic growth in 2026 (Source 2). The transformative power of AI lies in its ability to augment human capabilities, automate routine tasks, and enhance productivity.

One of the primary ways AI is transforming the labor market is by creating new job opportunities. According to a report by McKinsey, up to 800 million jobs could be lost worldwide due to automation by 2030. However, the same report also suggests that up to 140 million new jobs could be created, mainly in fields such as data science, AI development, and cybersecurity (Source not provided in the given sources, but mentioned for general knowledge). This shift towards a more digital and automated workforce requires workers to upskill and reskill to remain relevant in the job market.

Moreover, AI is expected to increase productivity, leading to higher economic growth. As per Vanguard’s report, AI investment’s outsized contribution to economic growth represents the key risk factor in 2026 (Source 2). The ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion. This investment cycle is still underway, supporting the projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years.

However, the labor market is not immune to the challenges posed by AI. The report by Vanguard highlights that the labor markets cooled markedly in 2025, and it may take some time for the labor market to stabilize. The unemployment rate is expected to stay below 4.5% by the end of 2026, but this is a modest acceleration in growth, supported by AI investment and fiscal thrust from the One Big Beautiful Bill Act.

In conclusion, the role of AI in transforming the labor market is multifaceted and far-reaching. While AI has the potential to create new job opportunities and increase productivity, it also poses challenges such as job displacement and the need for workers to upskill and reskill. As the labor market continues to evolve, it is essential for policymakers and businesses to invest in education and training programs that prepare workers for the changing job market.

AI Exuberance and Economic Upturn

The rise of AI startups in the U.S. has been nothing short of remarkable, with investors pouring billions of dollars into the sector. As we look ahead to 2026, it’s clear that AI exuberance will continue to drive economic growth, but with some caveats. According to Vanguard’s global chief economist, Joe Davis, financial markets are exuberant, and there are good reasons for that. Despite megatrend headwinds like demographic slowdowns and rising tariffs, economies held firm in 2025, with U.S. corporate earnings growth and fundamentals staying strong, powered by AI investment and positive technology shocks (Source 2).

In 2026, AI investment is expected to counteract negative shocks and drive economic growth. Vanguard’s data-driven megatrends framework suggests that supply-side forces will shift again, with AI investment playing a crucial role in shaping the economic outlook. The projections indicate an 80% chance that economic growth diverges from consensus expectations, with AI investment being a key driver of growth (Source 2).

The impact of AI on the labor market and productivity is expected to be significant, with AI investment’s outsized contribution to economic growth representing a key risk factor in 2026. The ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion, such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge (Source 2).

In terms of specific economic growth projections, Vanguard anticipates that the U.S. economy will achieve a more modest acceleration in growth to about 2.25% in 2026, supported by AI investment and fiscal thrust from the One Big Beautiful Bill Act. The first half of the year may be softer given the lingering effects of the stagflationary megatrend shocks of tariffs and demographics, as well as yet-to-materialize broad-based gains in worker productivity (Source 2).

While AI exuberance will continue to drive economic growth, it’s essential to note that this growth will come with some risks. The Federal Reserve is expected to have limited scope to cut rates below its estimated neutral rate of 3.5%, given the solid growth and still-sticky inflation. This suggests that investors should be cautious and consider the potential risks associated with AI-driven growth (Source 2).

In conclusion, AI exuberance and economic upturn will continue to shape the economic landscape in 2026. While the prospects for AI-driven growth are promising, investors should be aware of the potential risks and consider a cautious approach to investing in the sector.

Vanguard’s Economic and Market Outlook

Vanguard’s economic and market outlook for 2026 is characterized by a mix of optimism and caution. According to Joe Davis, Vanguard’s global chief economist, the global economy is poised for a modest acceleration in growth, driven by AI investment and fiscal thrust from the One Big Beautiful Bill Act. The U.S. economy is expected to grow at a rate of 2.25% in 2026, with AI investment playing a significant role in driving this growth (Source 2).

One of the key risks facing the economy in 2026 is the potential for AI investment to slow down, which could have a negative impact on economic growth. However, Vanguard’s analysis suggests that the ongoing wave of AI-driven physical investment is still underway, supporting a projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years (Source 2).

The labor market is also expected to play a significant role in driving economic growth in 2026. Although the labor market cooled markedly in 2025, it is expected to stabilize by the end of 2026, with the unemployment rate staying below 4.5%. This, in turn, is expected to lead to a moderate increase in wages and a subsequent boost to consumer spending (Source 2).

In terms of inflation, Vanguard’s forecast suggests that it will remain above 2% by the close of 2026, driven by solid economic growth and still-sticky inflation. This means that the Federal Reserve will have limited scope to cut rates below the estimated neutral rate of 3.5%. Vanguard’s Fed forecast is slightly more hawkish than the bond market’s expectations (Source 2).

In contrast to the U.S. and China, the euro area is expected to experience a more sluggish growth rate, hovering near 1% in 2026. This is due to the drag from higher U.S. tariffs, which is offset by increased defense and infrastructure spending. Inflation is expected to stay close to the 2% target, allowing the European Central Bank to maintain its current policy stance throughout the year (Source 2).

Overall, Vanguard’s economic and market outlook for 2026 is characterized by a mix of optimism and caution, with AI investment playing a significant role in driving economic growth in the U.S. and China. However, the potential for AI investment to slow down remains a key risk factor, and investors should be prepared for a range of possible outcomes.

AI Investment’s Contribution to Economic Growth

The contribution of AI investment to economic growth has been a significant factor in shaping the economic landscape of the United States in recent years. According to Vanguard’s analysis, AI investment’s outsized contribution to economic growth represents the key risk factor in 2026 (Source: Vanguard). The ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge.

Our analysis suggests that this investment cycle is still underway, supporting our projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years—a rate materially above most professional and central bank forecasts (Source: Vanguard). This growth is expected to be driven by AI investment, as well as fiscal thrust from the One Big Beautiful Bill Act.

The impact of AI investment on economic growth is expected to be significant, with Vanguard forecasting that AI will stand out among other megatrends, given its capacity to transform the labor market and drive productivity. The AI investment cycle is expected to continue to drive growth, with AI-related dynamics also influencing the economic growth forecast for China, which is expected to register 5% real GDP growth in 2026.

However, the economic growth forecast for the euro area is more consensus-like, given the lack of strong AI dynamics. The euro area is expected to experience growth of near 1% in 2026, as the drag from higher U.S. tariffs is offset by increased defense and infrastructure spending.

Overall, the contribution of AI investment to economic growth is expected to be a significant factor in shaping the economic landscape of the United States and other countries in 2026. As the AI investment cycle continues to drive growth, it is essential to understand the implications of this trend on the economy and to make informed investment decisions.

In the context of Nvidia’s growth prospects, the company’s position as a leader in AI chip design and its ability to capitalize on the growing demand for AI infrastructure spending make it an attractive investment opportunity. With AI investment’s outsized contribution to economic growth representing the key risk factor in 2026, Nvidia’s valuation of 38x forward earnings estimates remains reasonable, making it a potential buy for investors in 2026 (Source: Fool).

The Risk Factor in 2026: AI Investment’s Impact on the Labor Market and Productivity

The rapid growth of AI investment in the U.S. is poised to have a significant impact on the labor market and productivity in 2026. According to Vanguard’s analysis, AI investment’s outsized contribution to economic growth represents a key risk factor in 2026 (Source 2). The ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion, such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge.

This investment cycle is still underway, supporting our projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years, a rate materially above most professional and central bank forecasts (Source 2). However, this growth is not expected to be evenly distributed, and the labor market is likely to face significant challenges in 2026.

The labor markets, which cooled markedly in 2025, are expected to stabilize by the end of 2026, helping the unemployment rate to stay below 4.5% (Source 2). However, this stabilization may come at the cost of reduced productivity growth, as companies may struggle to adapt to the changing labor market landscape.

The impact of AI investment on productivity growth is a key concern in 2026. While AI investment is expected to drive significant productivity gains in the long term, the short-term effects may be more nuanced. According to Vanguard’s analysis, the first half of 2026 may be softer due to the lingering effects of stagflationary megatrend shocks, such as tariffs and demographics, as well as yet-to-materialize broad-based gains in worker productivity (Source 2).

The risk factor associated with AI investment’s impact on the labor market and productivity is significant, and investors need to be aware of this potential challenge in 2026. As AI investment continues to drive economic growth, it is essential to monitor the labor market and productivity trends closely to ensure that the benefits of this growth are shared equitably among all stakeholders.

AI-Driven Capital Expansion

The rise of AI startups in the U.S. has led to significant capital expansion in the sector, with investors putting their money in companies at the forefront of AI innovation. According to a prediction by Nvidia’s CEO, Jensen Huang, AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This growth is driven by the increasing demand for AI infrastructure, as cloud service providers and other companies expand their capacity to support AI applications.

Nvidia, a leading provider of AI chips, is well-positioned to benefit from this growth. The company’s GPUs are used in the training of AI and the application of the technology to real-world situations and problems. As AI infrastructure spending continues to grow, Nvidia’s revenue and profit are expected to increase, driven by strong demand for its Blackwell architecture and its update, Blackwell Ultra (Source 1).

Vanguard’s analysis suggests that the ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge (Source 2). This investment cycle is still underway, supporting Vanguard’s projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years.

The U.S. is positioned for a more modest acceleration in growth to about 2.25% in 2026, supported by AI investment and fiscal thrust from the One Big Beautiful Bill Act. The labor markets, which cooled markedly in 2025, should stabilize by the end of 2026, helping the unemployment rate to stay below 4.5%. Economic growth is expected to keep U.S. inflation somewhat persistent, remaining above 2% by the close of 2026 (Source 2).

The investment landscape for AI startups is expected to be shaped by the ongoing wave of AI-driven capital expansion. Investors are likely to focus on companies that are at the forefront of AI innovation, with a strong track record of growth and a clear path to profitability. As the demand for AI infrastructure continues to grow, companies that are well-positioned to capitalize on this trend are likely to see significant returns on investment.

In conclusion, the rise of AI startups in the U.S. has led to significant capital expansion in the sector, with investors putting their money in companies at the forefront of AI innovation. As AI infrastructure spending continues to grow, companies like Nvidia are well-positioned to benefit from this trend, driven by strong demand for their products and services.

A New Era of Investment Similar to the Railroad and Information Technology Ages

The investment landscape in the U.S. is on the cusp of a significant shift, driven by the rapid growth of artificial intelligence (AI) startups. Historically, major technological advancements have led to periods of unprecedented investment and economic growth. The development of railroads in the mid-19th century and the information and telecommunications surge in the late 1990s are prime examples of this phenomenon.

Similarly, the current wave of AI-driven investment is expected to be a powerful force, with Nvidia’s chief Jensen Huang predicting that AI infrastructure spending will reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This investment cycle is still underway, supporting our projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years—a rate materially above most professional and central bank forecasts (Source 2).

As AI investment continues to drive growth, we can expect to see a new era of investment, similar to the railroad and information technology ages. This will be characterized by significant capital expansion, innovation, and economic growth. In fact, Vanguard’s analysis suggests that this investment cycle is still in its early stages, with AI investment’s outsized contribution to economic growth representing a key risk factor in 2026 (Source 2).

The potential for AI investment to drive growth is substantial, with estimates suggesting that AI will stand out among other megatrends, given its capacity to transform the labor market and drive productivity (Source 2). This will likely lead to increased demand for AI infrastructure, including GPUs, which are currently in high demand due to their ability to power the training of AI and the actual application of the technology to real-world situations and problems (Source 1).

As we look ahead to 2026, it is clear that AI startups will be a key driver of investment and economic growth. With the potential for significant capital expansion, innovation, and economic growth, investors would be wise to take note of the opportunities presented by this new era of investment.

The Potential for 3% Real GDP Growth in the U.S. Economy

The potential for 3% real GDP growth in the U.S. economy is a topic of significant interest among investors and economists. Recent trends and forecasts suggest that this growth rate may be achievable in the coming years, driven in part by the continued expansion of AI infrastructure spending. According to Vanguard’s analysis, there is a 60% chance that the U.S. economy will achieve 3% real GDP growth, a rate materially above most professional and central bank forecasts.

One of the key drivers of this potential growth is the increasing demand for AI infrastructure, which is expected to reach between $3 trillion and $4 trillion by the end of the decade, according to Nvidia’s chief Jensen Huang. This demand is being driven by cloud service providers such as Amazon and Microsoft, which are planning to expand their capacity and require more powerful chips to support their AI infrastructure.

As this AI infrastructure spending story unfolds, companies such as Nvidia are well-positioned to benefit, with their GPUs being in high demand. Nvidia’s valuation remains reasonable at 38x forward earnings estimates, which could make it an attractive investment opportunity for those looking to capitalize on the growth potential of the AI industry.

However, it’s worth noting that the U.S. economy is not yet poised for 3% real GDP growth in 2026, according to Vanguard’s forecast. The first half of the year may be softer due to lingering effects of stagflationary megatrend shocks, such as tariffs and demographics, as well as yet-to-materialize broad-based gains in worker productivity. Nonetheless, the labor markets are expected to stabilize by the end of 2026, helping the unemployment rate to stay below 4.5%.

Overall, the potential for 3% real GDP growth in the U.S. economy is an exciting development that could have significant implications for investors and the broader economy. As the AI infrastructure spending story continues to unfold, it will be essential to monitor the progress of companies such as Nvidia and the broader economy to determine whether this growth potential becomes a reality.

(Source: Vanguard’s full economic and market outlook, as referenced in Kaynak 2)

AI Startups: Where Investors Are Putting Their Money

Investors are increasingly putting their money into AI startups, driven by the potential of artificial intelligence to transform industries and create new opportunities for growth. According to a recent analysis by Vanguard, AI investment is expected to be a powerful force in the coming years, reminiscent of past periods of major capital expansion (Source 2). This investment cycle is still underway, supporting the projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years.

Nvidia, a leading AI chip manufacturer, is expected to be a major beneficiary of this trend. The company’s CEO, Jensen Huang, has predicted that AI infrastructure spending will reach between $3 trillion and $4 trillion by the end of the decade, driven by soaring demand from cloud service providers such as Amazon and Microsoft (Source 1). This growth in demand is expected to drive significant earnings and stock price gains for Nvidia in 2026, making it a potential winner in the AI space.

Vanguard’s analysis also highlights the potential for AI-driven physical investment to drive productivity and transform the labor market. The company expects AI investment to contribute significantly to economic growth, representing a key risk factor in 2026. While the U.S. economy is expected to experience a more modest acceleration in growth to about 2.25% in 2026, driven by AI investment and fiscal thrust from the One Big Beautiful Bill Act, the potential for AI to drive growth and productivity makes it an attractive area for investors.

In terms of specific areas where investors are putting their money, NVIDIA’s GPUs are expected to be in high demand as AI infrastructure spending grows. Cloud service providers such as Amazon and Microsoft are also expected to invest heavily in AI infrastructure, driving growth in demand for NVIDIA’s products. Other areas where investors may be putting their money include AI-driven physical investment, such as robotics and autonomous vehicles, as well as AI-powered software and services.

Overall, the potential for AI to drive growth and productivity makes it an attractive area for investors, and NVIDIA is well-positioned to benefit from this trend. As AI infrastructure spending continues to grow, investors can expect to see significant earnings and stock price gains for NVIDIA and other AI-related companies in 2026.

The Rise of AI Infrastructure Spending

The AI infrastructure spending is expected to reach a staggering $3 trillion to $4 trillion by the end of the decade, as predicted by Nvidia’s CEO, Jensen Huang (Source 1). This significant investment will drive the demand for high-performance chips, such as Nvidia’s graphics processing units (GPUs), which are crucial for training and applying AI technology (Source 1). The growing need for AI infrastructure spending is evident in the plans of cloud service providers like Amazon and Microsoft to expand their capacity, leading to a surge in demand for Nvidia’s GPUs (Source 1).

This trend is not limited to the US market. Vanguard’s economic outlook suggests that AI investment will be a powerful force globally, driving economic growth and productivity (Source 2). The ongoing wave of AI-driven physical investment is expected to be a major contributor to economic growth, with a 60% chance of the US economy achieving 3% real GDP growth in the coming years (Source 2).

The rise of AI infrastructure spending is expected to have a significant impact on the US economy, with a modest acceleration in growth to about 2.25% in 2026, supported by AI investment and fiscal thrust from the One Big Beautiful Bill Act (Source 2). The labor markets are expected to stabilize by the end of 2026, helping the unemployment rate to stay below 4.5%. However, this growth is expected to keep US inflation above 2% by the close of 2026, limiting the scope for the Federal Reserve to cut rates.

The AI infrastructure spending trend is expected to continue globally, with China’s economic growth forecast to exceed consensus expectations in 2026, driven by AI-related dynamics (Source 2). In contrast, the euro area is expected to grow at a slower pace, with growth hovering near 1% in 2026, as the drag from higher US tariffs is offset by increased defense and infrastructure spending.

In conclusion, the rise of AI infrastructure spending is a significant trend that is expected to drive economic growth and productivity globally. As investors, it is essential to understand this trend and its implications for the economy and financial markets.

Nvidia’s Reasonable Valuation and Potential for Growth

Nvidia’s valuation has been a subject of interest among investors in recent times. Despite its impressive earnings growth and strong demand for its products, the company’s stock price has experienced some fluctuations. However, according to Jensen Huang, Nvidia’s chief, the company’s valuation remains reasonable at 38x forward earnings estimates (Source 1). This valuation is lower compared to other AI stocks, making it an attractive option for investors.

The company’s ability to deliver significant growth in earnings and stock price gains in 2026 can be attributed to its early entry into the AI space and its ongoing innovation. Nvidia’s GPUs have been instrumental in powering the training of AI and its application in real-world situations, making it a leader in the industry. The company’s Blackwell architecture and its update, Blackwell Ultra, have also seen strong demand from customers, including cloud service providers Amazon and Microsoft.

The increasing need for AI infrastructure spending is expected to drive Nvidia’s growth in the coming years. According to Jensen Huang, AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade. This trend is expected to benefit Nvidia, as its GPUs are the top-performing chips in the industry.

Vanguard’s analysis also supports Nvidia’s potential for growth. According to their data-driven megatrends framework, AI investment is expected to be a powerful force, driving productivity and transforming the labor market. The ongoing wave of AI-driven physical investment is expected to support the U.S. economy’s growth, with a 60% chance of achieving 3% real GDP growth in the coming years.

In conclusion, Nvidia’s reasonable valuation, combined with its strong demand for its products and the increasing need for AI infrastructure spending, make it an attractive option for investors looking to capitalize on the growing AI market. As the company continues to innovate and deliver significant growth in earnings and stock price gains, its potential for growth in 2026 looks promising.

The Importance of AI Investment in the U.S. Economy

The rise of AI startups in the U.S. is a significant development that holds immense economic potential. According to a recent prediction by Nvidia’s chief, Jensen Huang, AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This forecast is supported by the growing demand for AI chips, as evident from the soaring demand and expansion plans of cloud service providers like Amazon and Microsoft (Source 1).

The impact of AI investment on the U.S. economy is multifaceted. Firstly, AI has the potential to transform the labor market by automating routine tasks and increasing productivity (Source 2). This, in turn, can lead to significant economic growth, with projections suggesting a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years (Source 2).

Moreover, AI investment is expected to drive a wave of physical investment, reminiscent of past periods of major capital expansion, such as the development of railroads in the mid-19th century and the late-1990s information and telecommunications surge (Source 2). This investment cycle is still underway, supporting our projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years.

The importance of AI investment in the U.S. economy cannot be overstated. Not only does it have the potential to drive significant economic growth, but it also has the potential to transform various industries and create new opportunities for businesses and individuals alike. As Joe Davis, Vanguard’s global chief economist, notes, “AI investment’s outsized contribution to economic growth represents the key risk factor in 2026” (Source 2).

In conclusion, the rise of AI startups in the U.S. is a significant development that holds immense economic potential. The expected growth in AI infrastructure spending, driven by the increasing demand for AI chips, is expected to transform the labor market and drive productivity. This, in turn, can lead to significant economic growth, making AI investment a crucial factor in the U.S. economy’s future prospects.

References:

(Source 1) – Nvidia’s chief predicts AI infrastructure spending to reach between $3 trillion and $4 trillion by the end of the decade.

(Source 2) – Vanguard’s global chief economist, Joe Davis, highlights the top-level findings of Vanguard’s full economic and market outlook, including the projected growth in AI investment and its impact on the U.S. economy.

Investing in AI: Opportunities and Challenges

The AI industry has witnessed significant growth in recent years, with investors pouring substantial amounts of money into AI startups. However, as the market continues to evolve, investors are becoming increasingly cautious about the opportunities and challenges that lie ahead. In this section, we will delve into the world of AI investing, highlighting the opportunities that exist, as well as the challenges that investors need to be aware of.

Opportunities

One of the primary opportunities in AI investing is the rapid growth of the industry. According to a prediction made by Nvidia’s chief Jensen Huang, AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade (Source: Nvidia). This growth is driven by the increasing demand for AI-powered solutions in various industries, including healthcare, finance, and transportation.

Another opportunity in AI investing is the emergence of new business models. With the rise of AI, new business models are being created, such as subscription-based services and data-driven businesses. These models have the potential to generate significant revenue streams, making them attractive to investors.

Challenges

However, AI investing also comes with significant challenges. One of the primary challenges is the risk of an AI bubble forming. As the market continues to grow, there is a risk that investors will overpay for AI startups, leading to a bubble that eventually bursts. This is a concern that has been highlighted by the recent performance of Nvidia, which has experienced some ups and downs in recent months (Source: Fool).

Another challenge in AI investing is the lack of regulation. As AI becomes more pervasive, there is a need for regulation to ensure that the technology is used responsibly. However, the lack of regulation creates uncertainty and risk for investors, making it more challenging to invest in the industry.

Investing Strategies

Given the opportunities and challenges in AI investing, what strategies can investors use to navigate the market? One strategy is to focus on companies that are developing AI-powered solutions for specific industries. These companies are more likely to succeed in the long term, as they are addressing real-world problems.

Another strategy is to invest in companies that are developing AI infrastructure, such as cloud computing and data storage. These companies are likely to benefit from the growing demand for AI-powered solutions.

Finally, investors can also consider investing in AI-focused venture capital firms. These firms are well-positioned to identify and invest in the next generation of AI startups, providing investors with access to emerging AI companies.

In conclusion, investing in AI is a complex and challenging process. While there are significant opportunities in the industry, there are also challenges that investors need to be aware of. By understanding the opportunities and challenges, as well as using the right investing strategies, investors can navigate the AI market and potentially generate significant returns.

The Need for Diversification in a Frothy Market

As the AI market continues to surge, investors are faced with a pressing concern: the need for diversification in a frothy market. The rapid growth of AI startups has created a sense of exuberance among investors, with many pouring money into the space in search of the next big winner. However, this has led to a situation where investors are increasingly concentrated in a few high-flying stocks, leaving them vulnerable to a potential market correction.

According to Joe Davis, Vanguard’s global chief economist, the current market is indeed frothy, with financial markets experiencing exuberance due to megatrend headwinds in 2025 (Source 2). Despite this, the AI investment has contributed significantly to economic growth, making it a key risk factor in 2026. As a result, investors must be cautious and consider diversifying their portfolios to mitigate potential losses.

Nvidia’s recent earnings report, for example, may not have provided the boost investors were hoping for, despite the company’s strong performance (Source 1). This highlights the need for investors to look beyond individual stocks and consider a broader range of AI-related investments, such as cloud service providers and AI infrastructure companies. By diversifying their portfolios, investors can reduce their exposure to any one particular stock or sector, making them better equipped to weather a market downturn.

Furthermore, the ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion (Source 2). This investment cycle is still underway, supporting our projection of up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years. However, this growth is not without risks, and investors must be prepared for potential market volatility.

In conclusion, while AI startups continue to attract significant investment, investors must be mindful of the need for diversification in a frothy market. By spreading their investments across a range of AI-related sectors and companies, investors can reduce their exposure to potential losses and make their portfolios more resilient to market fluctuations.

The Potential for Unconventional Investment Opportunities

The rapidly evolving landscape of AI startups in the U.S. presents an array of unconventional investment opportunities for forward-thinking investors. As AI infrastructure spending is poised to reach between $3 trillion and $4 trillion by the end of the decade (Source 1), companies like Nvidia, which design the fastest graphics processing units (GPUs) on the market, are likely to see significant growth in earnings and stock price gains.

According to Joe Davis, global chief economist at Vanguard, AI investment will be a powerful force driving economic growth, with up to a 60% chance that the U.S. economy will achieve 3% real GDP growth in the coming years (Source 2). This growth is expected to be driven by AI investment’s capacity to transform the labor market and drive productivity, making it a key risk factor in 2026.

Investors who are willing to take on more risk may find opportunities in AI startups that are working on innovative applications of AI technology, such as natural language processing, computer vision, or robotics. These companies often have high growth potential, but they may also be more volatile and subject to increased regulatory scrutiny.

Another area of potential investment is in companies that are developing the infrastructure needed to support AI adoption, such as cloud computing providers, data storage companies, and cybersecurity firms. As AI infrastructure spending continues to grow, these companies are likely to see increased demand for their services and products.

Furthermore, investors may also consider investing in companies that are working on AI-related applications in specific industries, such as healthcare, finance, or transportation. These companies often have the potential for high growth and returns, but they may also be subject to increased competition and regulatory challenges.

In conclusion, the potential for unconventional investment opportunities in the U.S. AI startup market is vast and varied. While there are risks associated with investing in this space, forward-thinking investors who are willing to take on more risk may find opportunities for high returns and growth. It is essential to conduct thorough research and due diligence before investing in any company, and to consider seeking the advice of a financial advisor or investment professional.

The Importance of Staying Informed and Adaptable in the AI Era

As the AI landscape continues to evolve at a breakneck pace, it is crucial for investors, businesses, and individuals to stay informed and adaptable to navigate the rapidly changing landscape. According to a recent report by Vanguard, AI investment’s outsized contribution to economic growth represents a key risk factor in 2026 (Source 2). This highlights the need for a deep understanding of the AI ecosystem and its potential impact on various industries and markets.

The rise of AI startups in the U.S. is a prime example of the importance of staying informed and adaptable. As Nvidia’s chief Jensen Huang predicts, AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade (Source 1). This has led to a surge in demand for AI-powered chips, with companies like Nvidia at the forefront of this revolution. However, the AI bubble phenomenon has also raised concerns about overvaluation and potential market volatility.

To stay ahead of the curve, investors and businesses must be willing to adapt to the rapidly changing AI landscape. This requires a deep understanding of the latest AI trends, technologies, and applications, as well as the ability to identify potential risks and opportunities. As Vanguard’s report notes, the ongoing wave of AI-driven physical investment is expected to be a powerful force, reminiscent of past periods of major capital expansion (Source 2).

In the AI era, staying informed and adaptable is not just about keeping pace with the latest technological advancements; it’s also about understanding the broader economic and societal implications of AI. As AI investment continues to drive economic growth and productivity, it’s essential to consider the potential risks and challenges associated with this phenomenon, such as job displacement and income inequality.

By staying informed and adaptable, investors, businesses, and individuals can position themselves for success in the AI era. This requires a willingness to learn, experiment, and innovate, as well as a deep understanding of the complex interplay between technology, economy, and society. As the AI landscape continues to evolve, those who can stay ahead of the curve will be best positioned to capitalize on the opportunities and mitigate the risks of this rapidly changing world.

Summary

Here’s a compelling ‘Summary’ paragraph that summarizes the entire article, around 100-150 words:

The United States has emerged as a hub for Artificial Intelligence (AI) startups, attracting significant investments from both domestic and international investors. As the AI market is expected to grow exponentially, investors are putting their money into AI startups developing innovative solutions in areas such as natural language processing, computer vision, and robotics. Nvidia, a leading provider of AI chips, is poised to benefit from this trend, with its customers expanding capacity to meet growing demand for AI infrastructure. Vanguard’s economic outlook suggests a 60% chance of the U.S. economy achieving 3% real GDP growth in 2026, driven by AI-driven physical investment. While risks associated with AI investment exist, the potential rewards are significant, making AI startups an attractive investment opportunity in 2026. With significant investments pouring in, the AI startup landscape is poised for growth and expansion.